Are you looking to elevate your trading game? Look no further! In this blog post, we’ll dive into a proven swing trading strategy that boasts an impressive 78% win rate. By combining powerful indicators, we’ve created a simple yet effective setup that can transform your trading approach.

Introduction: A Powerful Swing Trading Strategy

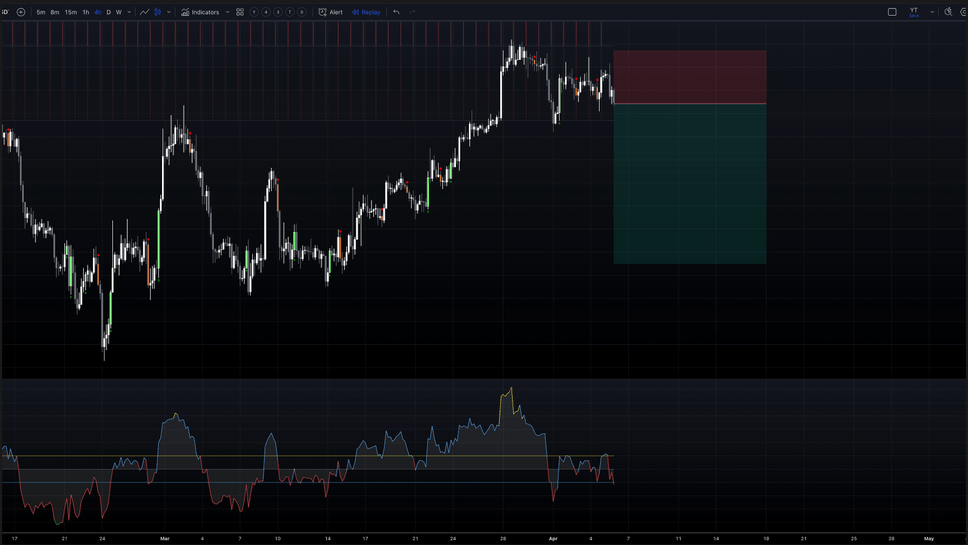

Let’s start with the foundation of our strategy: a trend filter, or dynamic support and resistance based on the ATR and Fibs. Add Buy and Sell signals indicator, and you have a solid base to build your strategy on. No need to reinvent the wheel – we’ve done the heavy lifting for you. With a few tweaks here and there, you’ll be ready to go. Let’s explore how this simple setup can revolutionize your trading.

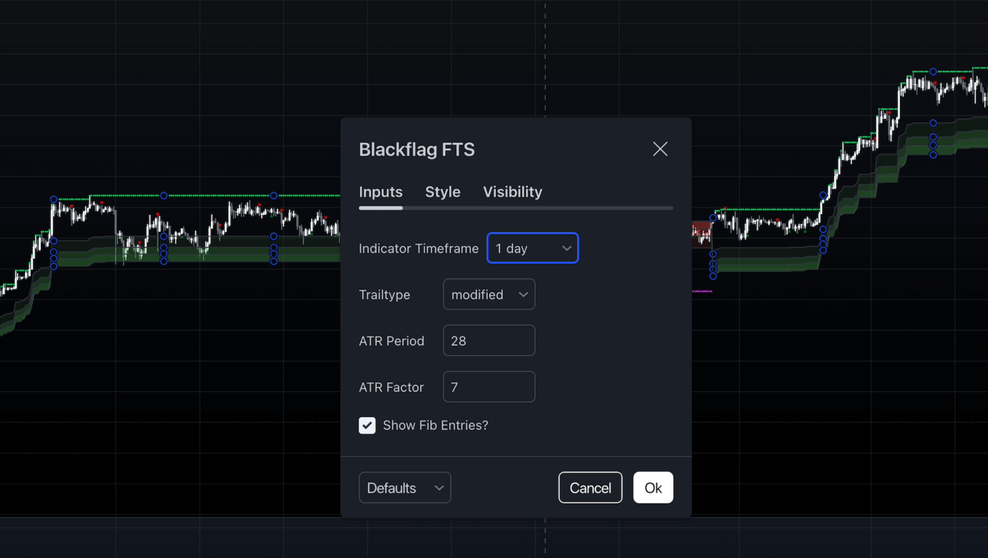

Mastering the Blackflag FTS Indicator for Trend Analysis

The Swing Arm ATR Trend Indicator, also known as Blackflag FTS, is a perfect tool for identifying support and resistance levels and measuring volatility. While it can be used for day trading, we’re focusing on a swing trading strategy today, so our settings reflect that approach.

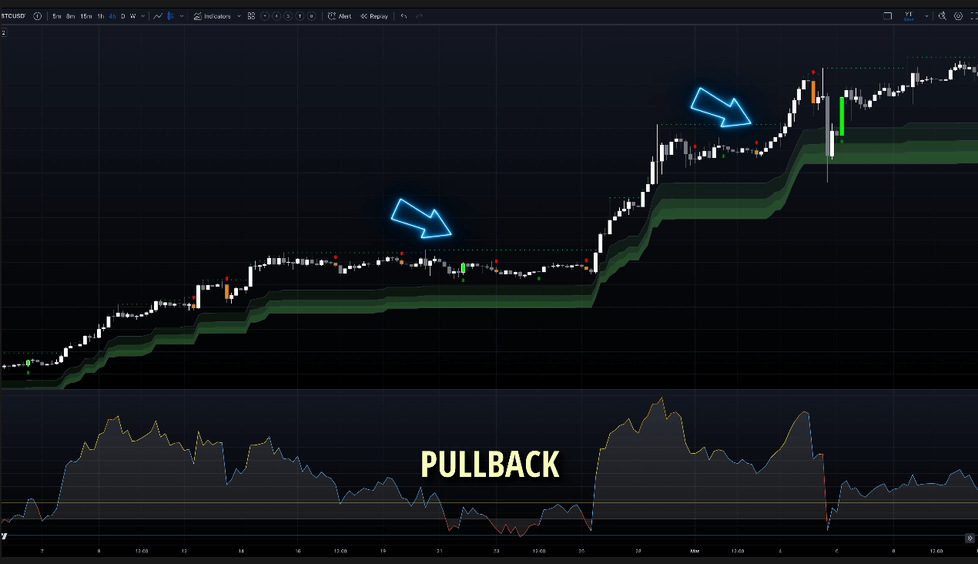

The Blackflag indicator provides clear areas to work with, without messy line crossovers. It offers three Fibonacci levels, allowing you to evaluate the depth of a pullback. The 100 level line, while its exact meaning is unclear, proves to be an effective tool in practice.

You can find the Blackflag FTS indicator on TradingView: SwingArm ATR Trend Indicator

Leveraging Forex Trading Signals 2.0 for Precise Entries

While the Blackflag is excellent, its buy and sell triangles don’t always perform as desired. This is where our star player comes in: Forex Trading Signals 2.0. Despite its name, this indicator works well with various instruments, not just forex pairs.

Forex Trading Signals 2.0 provides sniper-like entries, making it an ideal tool for our strategy. We’ll use it as our primary entry indicator.

You can find this indicator on TradingView: AUDUSD Swing Trading Signals 1DAY Timeframe

Enhancing Trade Accuracy with Bjorgum RSI

To further refine our strategy and eliminate false signals, we’ll incorporate the Bjorgum RSI. This indicator is essentially an improved version of the traditional RSI, offering a cleaner and more visually appealing representation.

For our strategy, we’ll set the Bjorgum RSI length to 20 and enable horizontal plots. You can find this indicator on TradingView: Bjorgum RSI

Step-by-Step Guide to Implementing the Strategy

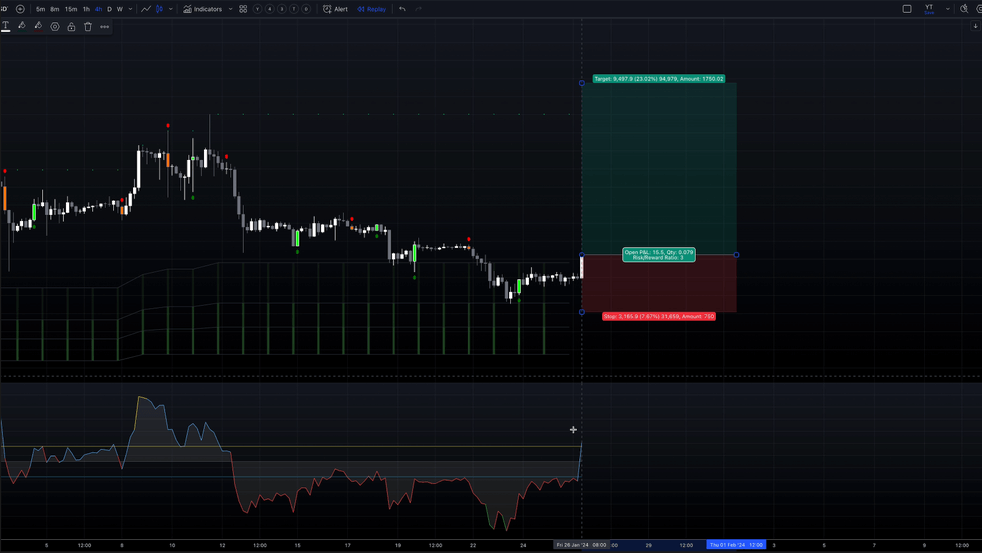

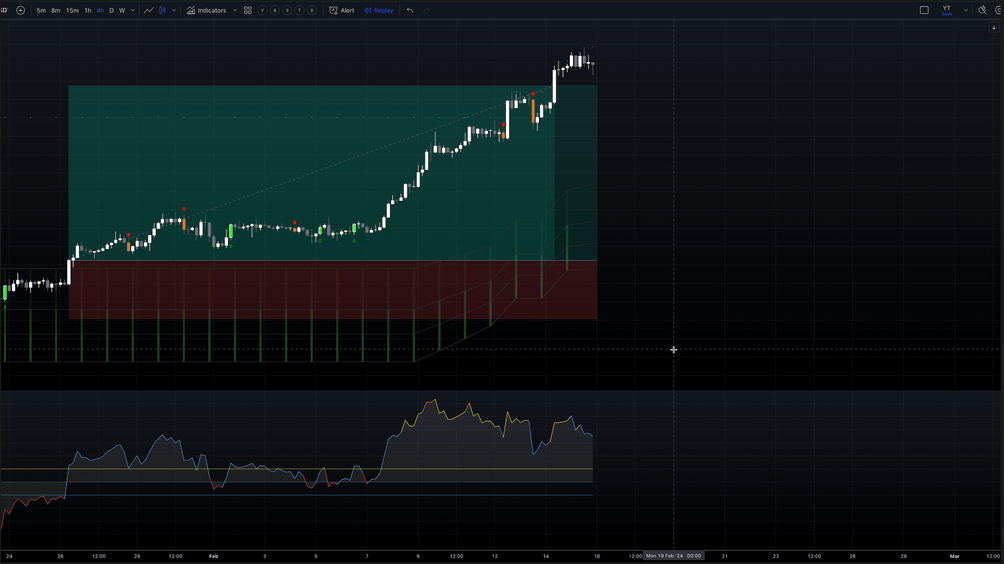

This strategy has shown the best performance on 4-hour and higher timeframes. We’ll use a multi-timeframe approach:

- Set the Blackflag chart period to daily.

- Use the 4-hour timeframe for entries.

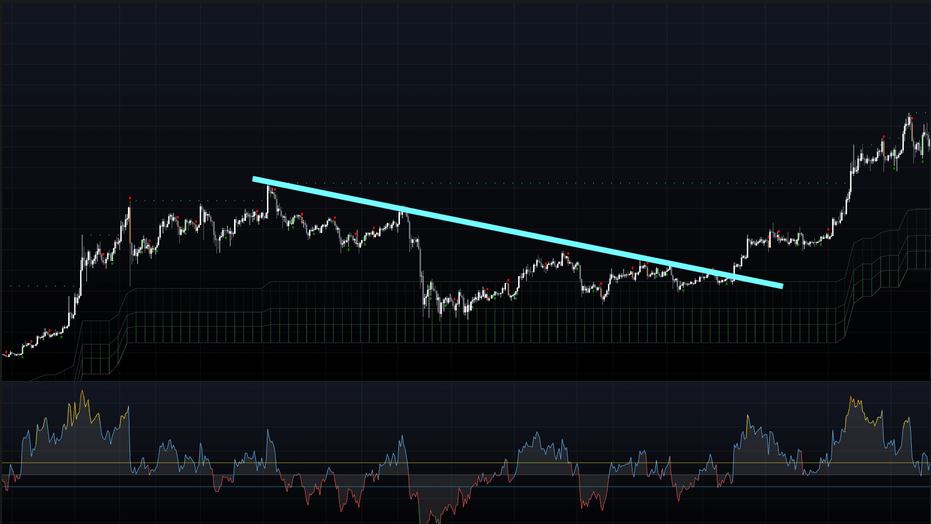

As you’ll likely hold positions for several days or even weeks, it’s crucial to enter at the best possible price. Look for entries during price pullbacks and use the Blackflag as your area of value. Enter trades when the price pulls back deep into the Fibonacci levels, but avoid crossing the 100 level. If the price crosses this level, it signals a weakening trend – cancel your setup and wait for the next opportunity.

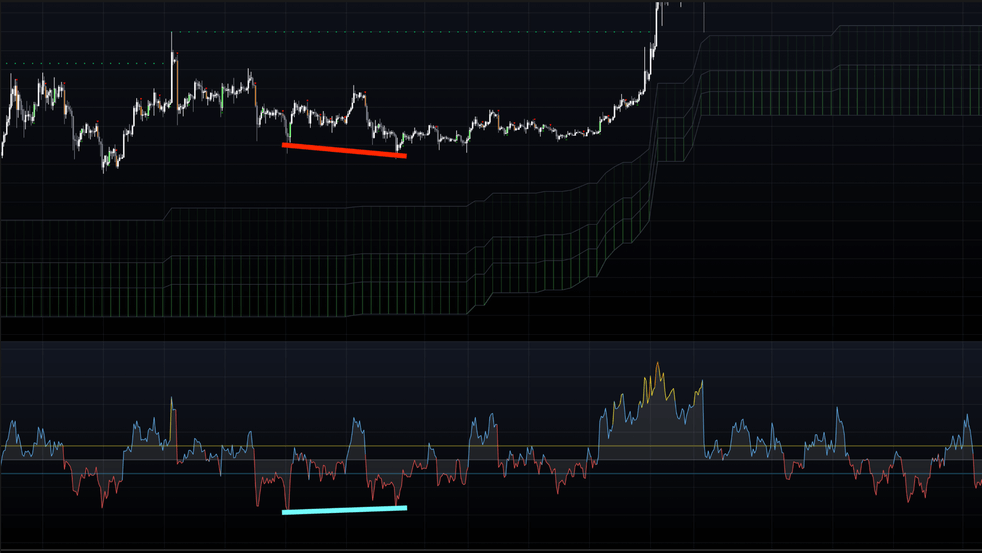

Sometimes, the price might reverse without touching the Blackflag. In such cases, look for leading signals like divergence or consider adding trendline breaks to eliminate false entries and improve your entry timing.

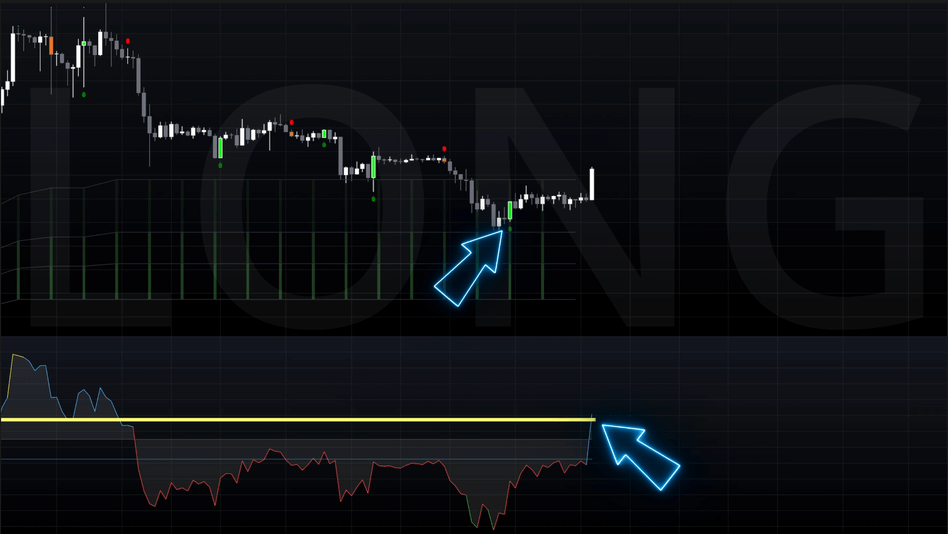

For a long position:

- Look for a buy signal (green candle)

- Confirm with the RSI above the 55 level

- Only take trades aligned with the Blackflag trend (green)

- Enter on a candle close

For a short position:

- Look for an orange candle close

- Confirm with the RSI below the 45 level

- Take only trades aligned with the Blackflag’s direction

Expanding Your Trading Arsenal: Next Steps

Having multiple effective trading strategies in your arsenal is crucial for success. Consider exploring reversal and pullback approaches to further elevate your trading game. Additionally, keep an eye out for our upcoming detailed tutorial on divergence – you won’t want to miss it!

By mastering this proven swing trading strategy and continuing to expand your knowledge, you’ll be well on your way to becoming a more successful and confident trader. Happy trading!