Are you new to trading or looking to simplify your approach? This beginner-friendly trading strategy using three free TradingView indicators might be just what you need. We’ll explore how to master trend identification, pinpoint entries, and manage risk effectively.

The Power of Simplicity in Trading

In the complex world of trading, sometimes less is more. This strategy is designed to be straightforward yet effective, using just three indicators:

- One to show trend direction

- Another to signal entries

- And a third to guide stop loss and take profit placement

While it may sound easy, remember that successful trading still requires analysis and practice. Let’s dive into each indicator and how they work together to create a robust trading strategy.

EMA Ribbon: Your Trend Direction Compass

The first indicator we’ll use is the EMA (Exponential Moving Average) ribbon, specifically the MA Ribbon R5. This versatile tool offers:

- A variety of moving averages to choose from

- Color-coded candles for easy trend identification

- Adjustable timeframe settings

For our strategy, we’ll focus on its color coding:

- Green candles indicate an uptrend

- Red candles signal a downtrend

This simple visual cue helps us quickly identify the overall market direction.

Settings: We’ll use the default settings with a fast period EMA at 50 and a slow period at 100.

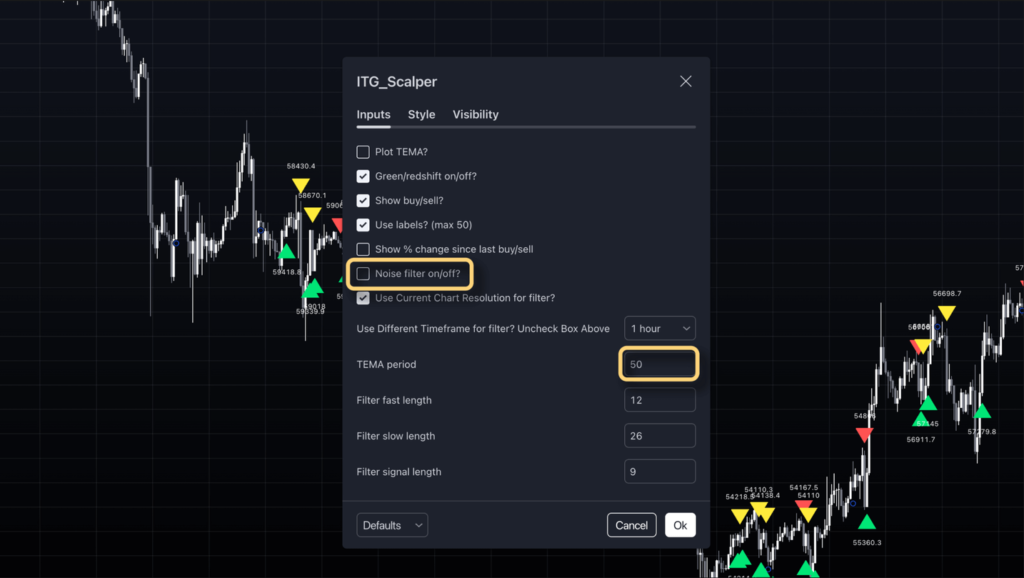

ITG Scalper: Pinpointing Precise Entry Points

Our second indicator is the ITG Scalper, which we’ll use to identify entry points. This indicator is based on a triple exponential moving average (TEMA).

Key Point: Since we’re using the EMA ribbon for trend identification, we’ll disable the ITG Scalper’s trend identification feature to avoid conflicting signals.

Settings:

- Set TEMA period to 50

- Untick the noise filter

Note: The ITG Scalper is based on a MACD (Moving Average Convergence Divergence) and may sometimes give slightly delayed entry signals.

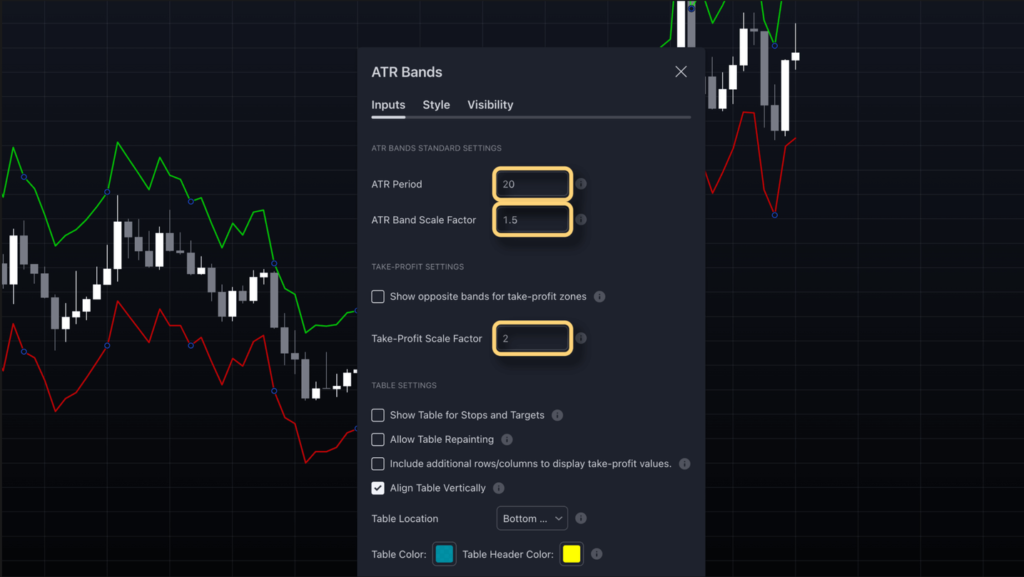

ATR Bands: Managing Risk and Reward

The third indicator is the ATR (Average True Range) bands. This optional tool helps with:

- Stop loss placement

- Take profit levels

Pro Tip: ATR bands can clutter your chart, so toggle them on and off as needed, typically when placing a trade.

Settings:

- ATR period: 20

- Band Scale Factor: 1.5

- Take Profit Scale Factor: 2 (adjustable based on your risk tolerance)

Implementing the Strategy: Rules for Success

Now that we’ve set up our indicators, let’s discuss how to use them effectively:

- Follow the Trend: Buy in green (uptrend) and sell in red (downtrend).

- Look for Confirmations: Don’t rely solely on buy/sell signals. Seek additional confirmations like support, resistance, or structure breaks.

- Use Trendlines: When price pulls back, draw a trendline and wait for it to break. Once it does, confirm with a valid buy/sell signal, depending on the trend direction.

- Stop Loss Placement:

- For long positions: Place stop loss below the entry candle at the lower ATR band

- For short positions: Place stop loss above the entry candle at the upper ATR band

- Take Profit: Set your take profit at the opposite ATR band.

- Risk Management: If you prefer not to use ATR bands, a classic fixed risk-reward ratio like 1:2 can work well in most cases.

Remember, successful trading isn’t just about following signals. It’s about combining multiple confirmations to create a more robust strategy.

Conclusion

This beginner-friendly strategy provides a solid foundation for new traders while offering valuable insights for more experienced ones. By combining trend analysis, precise entry points, and risk management, you’re setting yourself up for more informed trading decisions.

As you practice and refine this strategy, you’ll develop a better feel for market movements and improve your trading performance. Remember, consistency and discipline are key to long-term trading success.

Happy trading!

Want to dive deeper? Check out our recent video on a highly profitable swing trading strategy for more advanced techniques and insights.