Are you looking for a powerful AI-driven trading indicator that combines candlestick patterns with moving averages? The Helacator AI Theta indicator might be exactly what you need. In this comprehensive guide, we’ll explore how this innovative tool can enhance your trading strategy through smart pattern recognition and trend analysis.

Unveiling the Power of Helacator AI Theta

The Helacator AI Theta stands out through its intuitive visual approach to market analysis. At first glance, traders will notice its distinctive buy and sell labels strategically placed at key market points. These signals are further enhanced by dynamic price bar coloring that adapts to reflect current market conditions as interpreted by the indicator’s artificial intelligence.

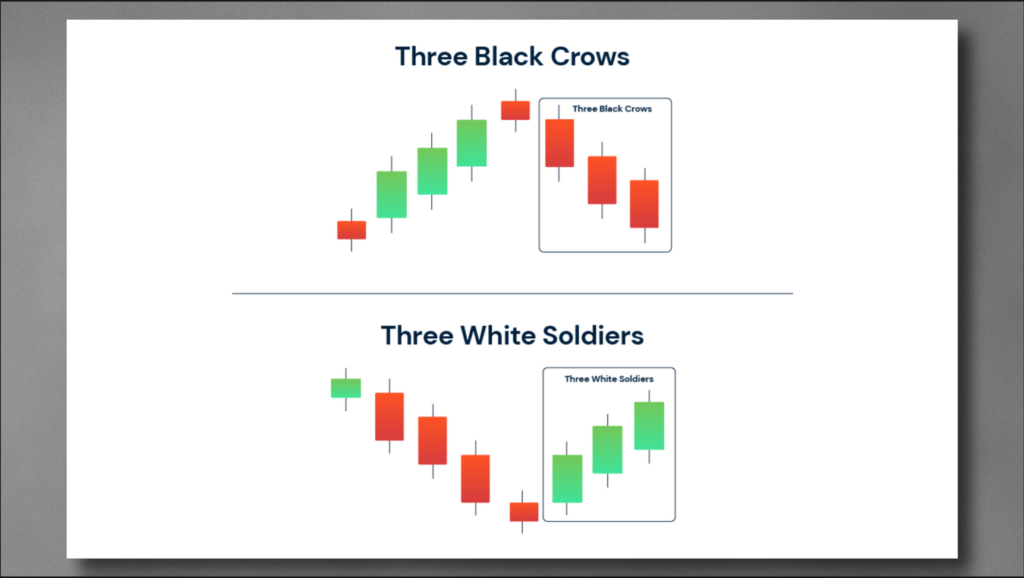

Beyond its visual appeal, the indicator’s core strength lies in its sophisticated analysis of market trends. By utilizing moving averages, it maintains a constant pulse on overall market direction while simultaneously scanning for specific candlestick patterns. The indicator pays particular attention to powerful formations such as the Three White Soldiers and Three Black Crows, which often signal significant market reversals or trend continuations.

One of the most innovative features of this indicator is its optional cooldown filter. This unique mechanism acts as a signal quality control system, preventing the generation of excessive signals that could lead to overtrading. By implementing this cooldown period, traders can focus on higher-probability setups and make more measured trading decisions.

Mastering the Settings and Parameters

The indicator provides clear visual signals directly on your chart through:

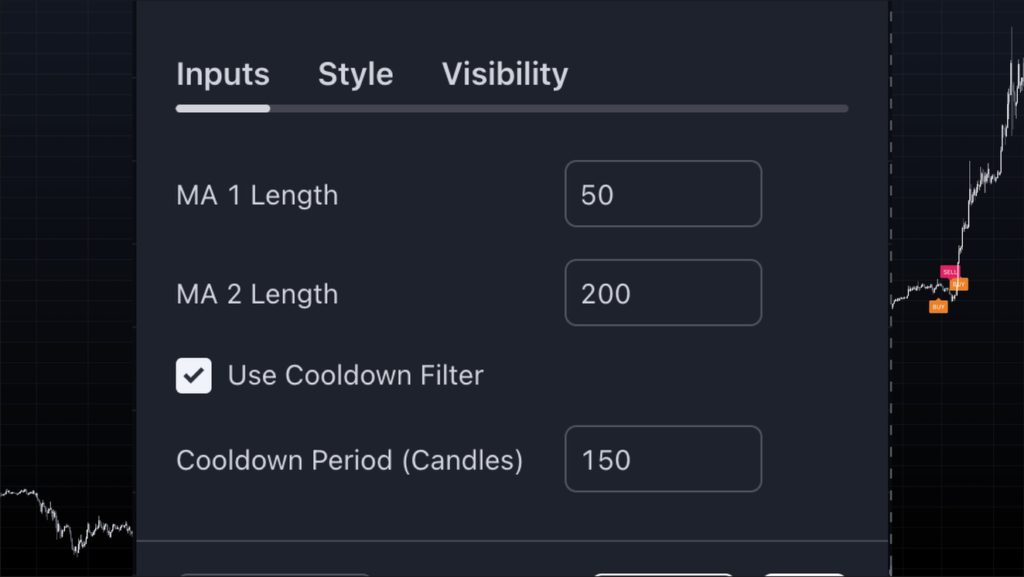

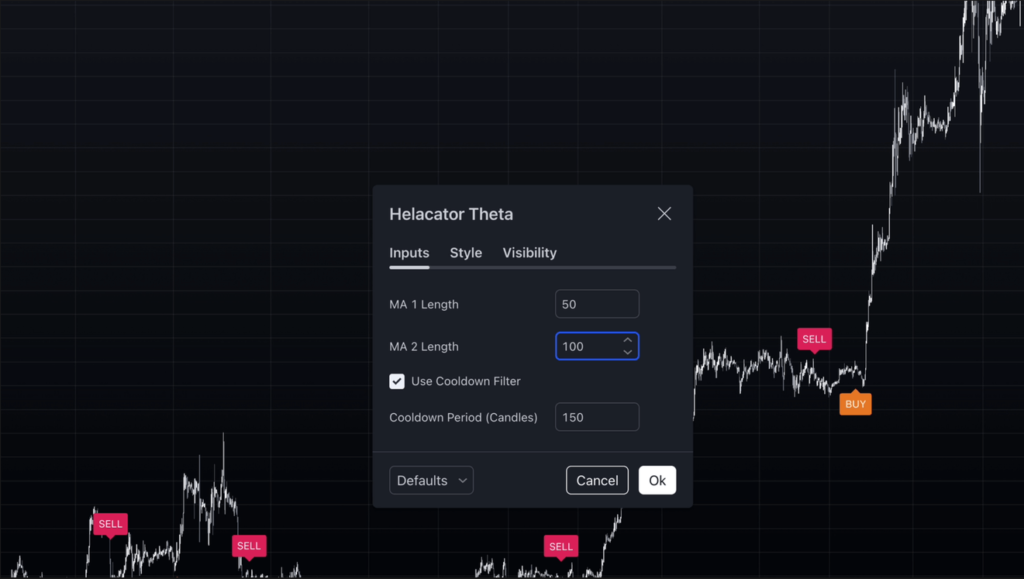

- The Helacator AI Theta comes with calibrated default settings that provide a good starting point for most traders. The indicator employs two simple moving averages: a shorter-term 50-period MA for capturing immediate price movements, and a longer-term 200-period MA for broader trend identification. The default cooldown period is set to 150 candles, striking a balance between signal frequency and quality.

- For traders seeking to optimize their experience, the indicator offers considerable flexibility in its configuration. Those looking for a middle-ground approach might consider adjusting the longer-term moving average to 100 periods, which can provide a more responsive yet still reliable trend filter. Traders preferring more frequent signals can experiment with reducing the cooldown period or disabling it entirely.

- However, it’s crucial to understand that these settings should be tailored to your specific trading environment. Factors such as your chosen timeframe and the characteristics of your traded assets should influence your parameter selections. Success often comes through careful experimentation and thorough backtesting to find the optimal configuration for your trading style.

Enhancing Signal Quality with Complementary Indicators

The indicator’s strength lies in its multi-faceted approach to market analysis:

- While the Helacator AI Theta is a powerful standalone tool, its effectiveness can be amplified when combined with complementary technical analysis instruments. Volume indicators serve as excellent companions, providing crucial confirmation of pattern strength. Oscillators such as the RSI or Stochastic can offer valuable insights into overbought or oversold conditions, adding another layer of confirmation to your trading decisions.

- Short-term MA for immediate price movements

- Long-term MA for broader trend identification

- Support and resistance tools, particularly the Bjorgum Key Levels, can provide essential context to the signals generated by the Helacator Theta. This combination helps traders understand whether signals align with significant price levels, potentially increasing the probability of successful trades.

- For traders seeking a more automated approach, pairing the Helacator Theta with the Supertrend indicator can create a robust trading system. The Supertrend can provide primary directional bias, while the Helacator Theta offers sophisticated confirmation signals, creating a comprehensive trading framework.

Conclusion

The Helacator AI Theta represents a significant advancement in technical analysis tools, offering traders a sophisticated way to analyze market conditions and identify trading opportunities. While powerful on its own, its effectiveness can be maximized through proper configuration and integration with complementary indicators.

Remember that successful trading requires more than just good indicators – proper risk management and consistent strategy application are equally important for long-term success.

Ready to try the Helacator AI Theta? Find it on TradingView: Helacator AI Theta By cowdaprettylad